There’s a lot riding on the technology choices enterprises make. However, a winning strategy for mainframe modernization and reducing regulatory risk means more than just selecting the best tech: It calls for access to a comprehensive solution addressing business, regulatory, and technological challenges.

When it comes to financial services, the stakes are high for successful modernization. Although the finance sector accounts for an estimated 20-25% of the global economy, banks and other financial institutions are facing headwinds. Many macroeconomic factors significantly challenge this industry -- including interest rate risk, GenAI impact, and climate risk management – making greater fiscal discipline essential for a competitive edge.

Rapidly evolving regulatory complexities, and the impending mandates around operational resiliency, business continuity, and data sovereignty make conditions even more challenging. Meanwhile, mainframes and legacy databases hinder CIOs who are tasked with reducing their operational expenditure, improving business agility, and attracting new talent to the workforce.

These realities make Cockroach Labs’ recently announced strategic collaboration with PwC UK, a leader in professional services, a welcome development. Our partnership offers uniquely comprehensive end-to-end solutions that reduce the risks, costs, and complexity of regulatory compliance and mainframe modernization for the financial sector. It’s the optimal convergence of people, process, and technology to help global enterprises accelerate time- to- value in their compliance and modernization initiatives.

Elevating Operational Resilience

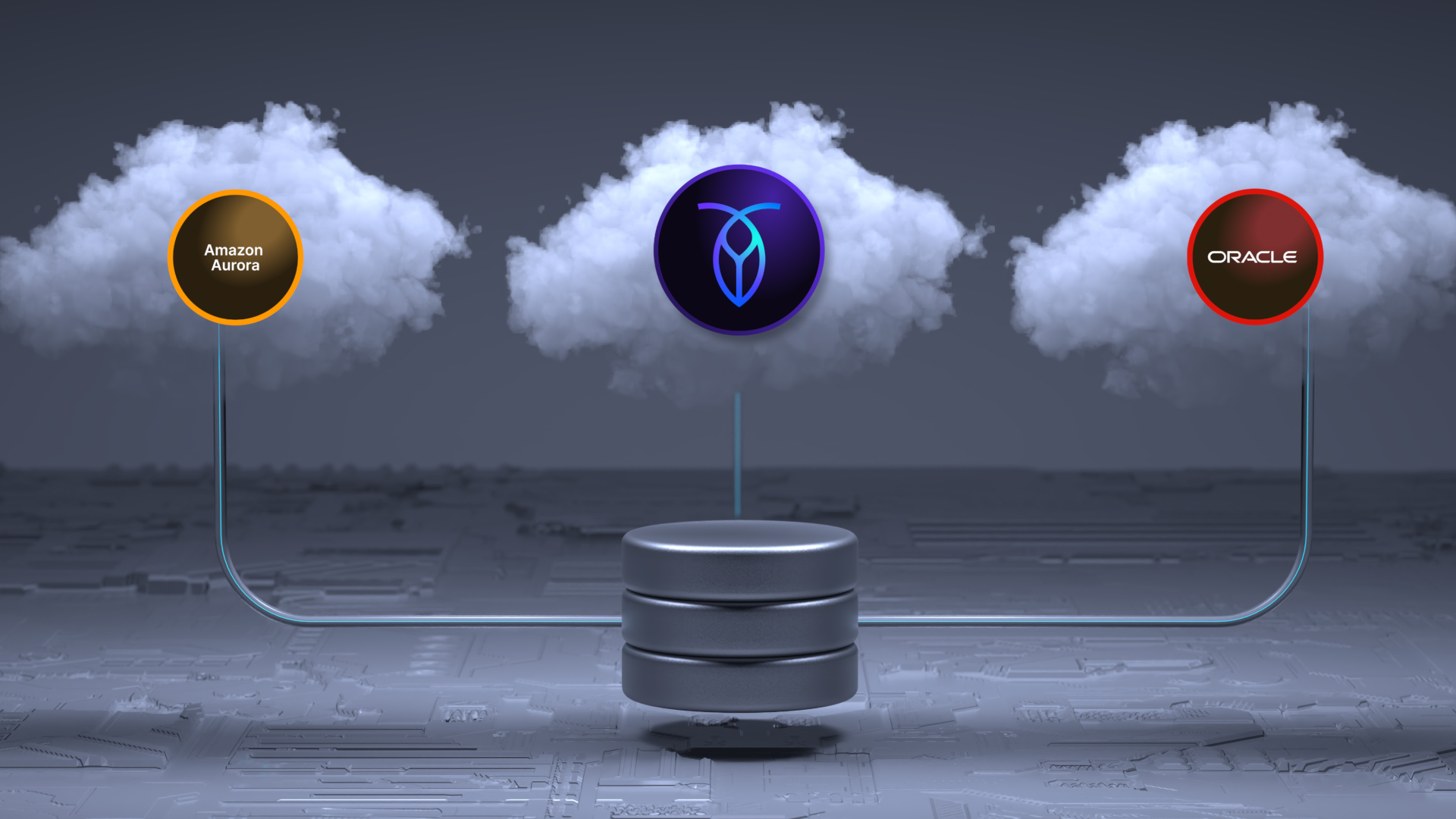

With the enactment of EU regulations such as the Digital Operational Resilience Act (DORA), bolstering operational resiliency is a must for financial firms. Multi-region and multi-cloud platforms are key for maintaining resilient operations during severe disruptions – the ability of CockroachDB to serve queries even when nodes, availability zones, and entire regions fail is crucial for resilient data architectures.

“The recent CrowdStrike outage, which caused significant downtime industry-wide, underscores the Prudential Regulation Authority’s (PRA) recent supervisory statement encouraging financial services to eliminate vendor concentration risk,” says Allen Terleto, Head of Global Partners and Ecosystem, Cockroach Labs. “Disaster recovery planning is no longer good enough. Enterprises, considered critical to the financial infrastructure, are looking for cloud-agnostic distributed technologies that can provide them with multi-region business continuity and ensure portability between clouds, on-premises, and everywhere in between.”

Data Sovereignty Compliance: It’s Complicated

Compliance with cross-border data transfer is becoming increasingly complex for banks and financial institutions: Data sovereignty regulations change constantly, with each country and jurisdiction taking their own approach to adequacy arrangements and privacy rules.

PwC UK’s expertise helps global enterprises navigate these challenges every day. Combined with CockroachDB’s distributed SQL database to support data domiciling in multi-region clusters, and hybrid environments, we provide a comprehensive solution for financial firms seeking compliance with evolving data sovereignty regulations.

Banks are finding it increasingly difficult to balance data sovereignty compliance with customer experience. “Let’s take the example of a global bank reliant on the mainframe,” Terleto explains. “It has customers that are on the move – they may reside in the UK, but they travel to the US, China, or India on a regular basis and they want to have a uniform banking experience in those countries, the same as they enjoy in the UK.

“If all of the bank’s customer data resides in the UK – and it has a regulatory environment that doesn't allow it to share data outside its borders – it must find a way to provide that same user experience without adding operational complexity and costs. What the bank needs is a single technology that can scale globally, but still maintains data residency by ensuring that its customer’s data stays within its jurisdiction.

“What they don't want to do is replicate the entire technology stack in each individual country, standing up isolated databases which create an operational nightmare for their administrators, globally. That not only increases costs, but also raises the question, ‘How do we keep that data and user experience consistent?’”

Banks and financial institutions want a new generation of solutions: CockroachDB’s global database deployment capabilities increase operational simplicity and reduce the risks with data sovereignty compliance. "CockroachDB provides a solution that seamlessly solves data sovereignty challenges across different regions,” observes Jon Maskery, Cloud Transformation and Payments Leader, PwC UK. “So not only do you have a solution that is resilient because it sits across multiple clouds, it's also multi-region addressing the increasingly high regulatory resilience requirements.

“Additionally, the performance of CockroachDB meets the needs of the customers as it is horizontally scalable,” he continues. “For example, it’s an optimal fit for real time processing and working with large sets of data very quickly to go through end-of-day processing."

Beyond the Mainframe: Data Modernization

Mainframes and monolithic databases have been a fixture of IT infrastructure for over 50 years. Increasingly, however, CIOs are planning migrations to cloud architectures for reduced operational costs, improved business agility, and to attract a generation of new talent.

PwC UK has expertise at mitigating modernization risks by identifying the ideal migration strategy, facilitating advanced tooling for accelerated migrations, and preparing a rollout plan. Together, Cockroach Labs’ collaboration with PwC UK drives legacy mainframe and database modernization initiatives forward so organizations can deliver cost efficiency, unlock siloed on-premises data for Gen-AI readiness, and advance their IT capabilities.

“Mainframes were designed during a moment in time when reducing storage cost was the primary concern– however fast forward 50 years, and that constraint has long passed,” says Terleto. “Though we now have access to commodity storage, whether it's on the cloud or on-prem, legacy monolithic database architecture fundamentally remains the same. They can neither horizontally scale-out to meet the demands of today’s customer experience and trading volumes, nor benefit from the cost-efficiencies of running across cloud infrastructure to reduce total costs of ownership.”

As a result, banks and financial institutions that remain mainframe-dependent continue to absorb the ever-increasing costs of an aging workforce and scaled-up infrastructure. “Financial institutions are navigating multiple headwinds, whether its macroeconomic conditions or increasing regulatory risks – they simply cannot kick the can down the road on modernization anymore,” Terleto notes. “Whether it's leveraging the cloud to gain business agility, attracting a new generation of talent that can support the operation for the next 20 years, or simply moving to a business continuity strategy that includes more than two datacenters, modernizing to the next-gen distributed database architecture is an inevitability.

“This is where Cockroach Labs stands above the rest,” he continues. “We’ve built a database that rivals the 7-9s resiliency enterprises enjoyed on the mainframe. We’ve built a database that allows enterprises to seamlessly transition their workforce’s skill sets through SQL-familiarity, hybrid deployments, and feature-parity with DB2, Oracle, and SQL Server. And we’ve reduced the risks, duration, and costs of delivering modernization projects by building a global network of partners that specialize in every prominent migration strategy - whether it be re-write, re-factor, or re-platform.”

Partnership Power

We’re excited about PwC UK’s strategic collaboration with Cockroach Labs. Together, we’re uniquely equipped to provide comprehensive business and technology solutions for financial services, such as:

banks who need help with mainframe modernization

payment systems mitigating operational resiliency risk

cross-border fintechs navigating data sovereignty regulations

“Our world-class partner network is how Cockroach Labs does even more for our customers,” says Allen Terleto. “Partnering with PwC UK is a great collaboration, joining their unsurpassed business value with our highly resilient distributed database.”

Visit here to learn more about our strategic collaboration with PwC UK.

David Weiss is Senior Technical Content Marketer for Cockroach Labs.